Automate Investment Commentary

The convergence of the investment mind and the AI machine

Arria Investment Analyst™ streamlines the complex value chain of investment analysis, eliminates inaccuracies and accelerates data understanding. Utilising Natural Language Generation (NLG), Arria Investment Analyst can automate* investment commentary freeing expert analysts to focus on client relationships.

- Automate 80% of manual reporting

- Self-service on-demand reporting

- Streamline the value chain process

- Enhance operational benefits

*Read more about HyperAutomation strategy

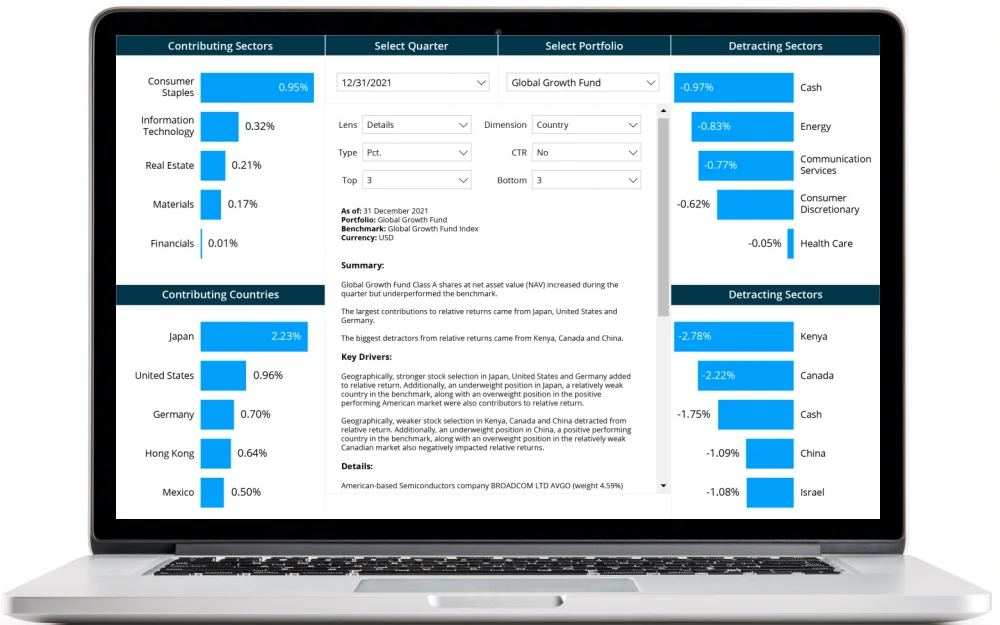

Arria Investment Analyst allows users to easily and efficiently execute portfolio versus benchmark analysis

Asset and fund managers are required to examine volumes of data including portfolio securities, and data pertaining to the different segments they need to drill through. This includes country industries, sub-industries and how their portfolio is allocated. Arria Investment Analyst allows you to absorb all of your investment data in a fast ‘button click’ solution, delivered in a narrative format, through Arria NLG.

The traditional communication of data for an analyst to then compile would take several hours. Arria Investment Analyst can perform the task in seconds while presenting the information through a tailored narrative. Users are in full control of how the narrative will be presented and the language used. This means there will be no wasted time translating the output, it’s all ready to use and fit for purpose.

Arria Investment Analyst utilises a scalable automatic process that pulls in benchmark and portfolio information and instantly produces narratives that talk at a high level about how the portfolios performed. Aria Investment Analyst can generate fund fact sheets, key insights, or key drivers.

When you interrogate data at a country level, Arria Investment Analyst will deliver a narrative explaining how countries overperformed and contributed to the growth/decline of your portfolio, and which countries detracted from it.

Arria Investment analyst also summarises the key details, including the securities by surmising the securities that performed well and those that underperformed. Through automation it then describes the differences between them in the form of a commentary.

How does Arria Investment Analyst integrate with Qlik?

Arria’s AI engine will read and interpret data to present investment insights. Financial services organisations and finance departments can integrate Arria Investment Analyst into their current Qlik installation as an extension. The Arria NLG Qlik extension will then generate narratives from the data underlining their analytics.

Arria Investment Analyst’s natural language generation (NLG) allows Qlik or your other BI tools (e.g. Power BI) to empower all portfolio users, with new levels of accessibility and understanding of investment data.

Streamline the complex value chain of investment analysis

Arria Investment Analyst provides multi-fund report narrative analysis and the ability to slice and dice data when analysing portfolios. Investment commentary becomes personalised, as opposed to generic, with quality, consistency, and dynamic on-the-fly applicability for internal and external consumers.

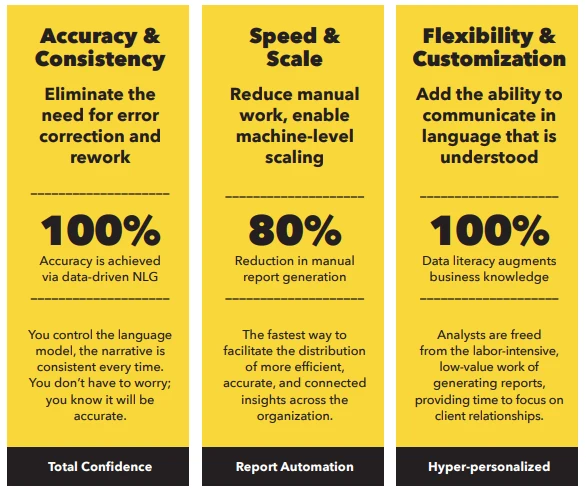

Analysis that can provide both objective and subjective information, which used to take hours to perform, can be automated averaging four seconds, giving your investment commentary superhuman speed and accuracy.

Surface hidden insights, anomalies, and implications with the click of a button

Arria Investment Analyst uses NLG intelligence to analyse investment portfolio performance. The slice and dice capability allows you to discover insights and receive personalised, data-driven explanations to support your investment decision-making process and reporting.

Automate your investment commentary to turn pain points into gain points

Investment analysts typically engage in highly manual work to create an investment commentary after uncovering and documenting insights from data and BI dashboards. Before automation by Arria Investment Analyst, this task was costly, time-consuming, and difficult to scale.

Key details were missed due to time spent on gathering data and preparing reports—often in an unbreakable single-step sequence. When essential pieces of information required to make timely decisions were missing, the production of important reports was delayed and there was no time for quality checks.

The deployment of Arria Investment Analyst allows for the following ‘gains’:

- Downgrade the risk of human error: the data-driven narratives provide automation whilst enhancing data literacy by delivering personalised output.

- Analysts no longer need to describe all steps manually, before giving insights. Narratives are comprehensive, replicating business knowledge across the organisation and emulate your firm’s voice.

- Decision-makers and users save time with direct access to self-serve, instantly generated narratives that are specifically tailored to their areas of interest.

- Companies reduce costs and offer improved experiences by freeing employees from repetitive and highly manual work, allowing analysts to do the work they want to do.

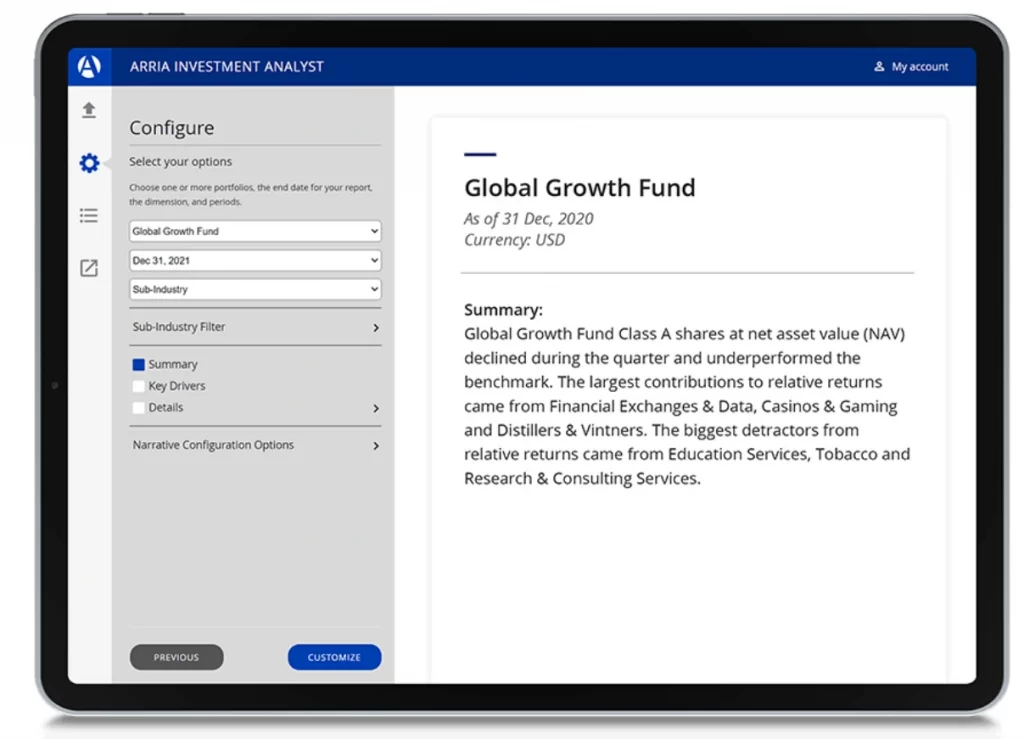

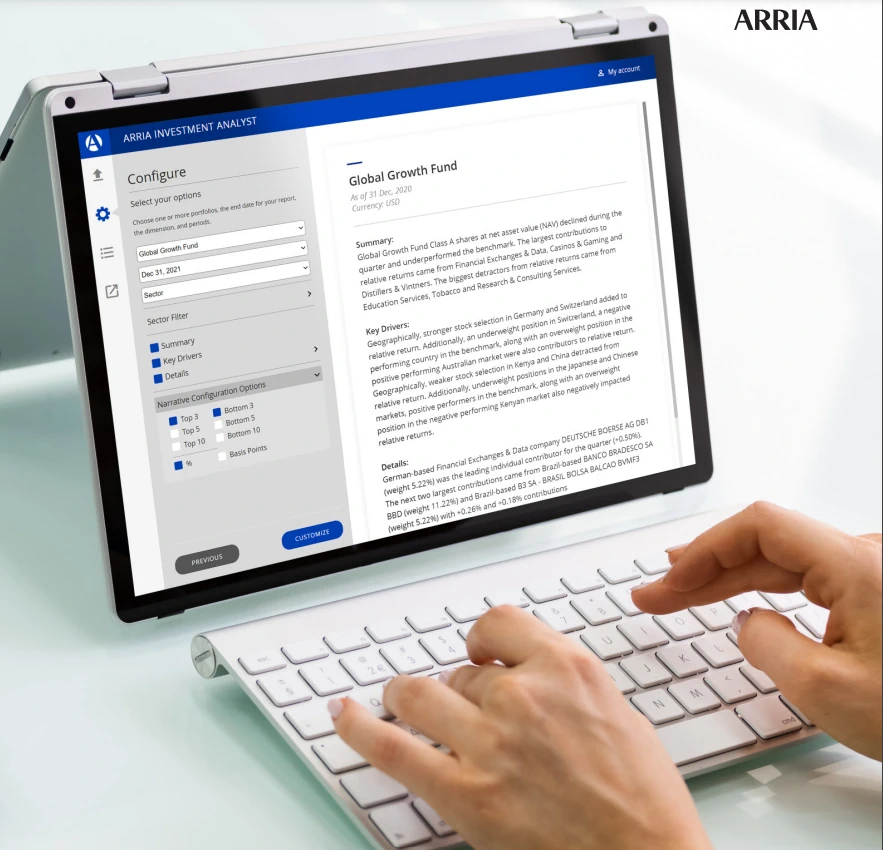

Access anytime, anywhere

Simply connect your data in a standard format, select your configure options, customise the narrative (if you wish), and consume when and where it’s convenient. With the click of a button, you can dynamically generate data-driven narrative summaries—all using an intuitive user interface. By utilising Text to Speech software (TTS) you can listen to your portfolio updates on the move.

Connect

Upload information from your current data sources. Arria Investment Analyst’s file format is readily compatible with all the main providers.

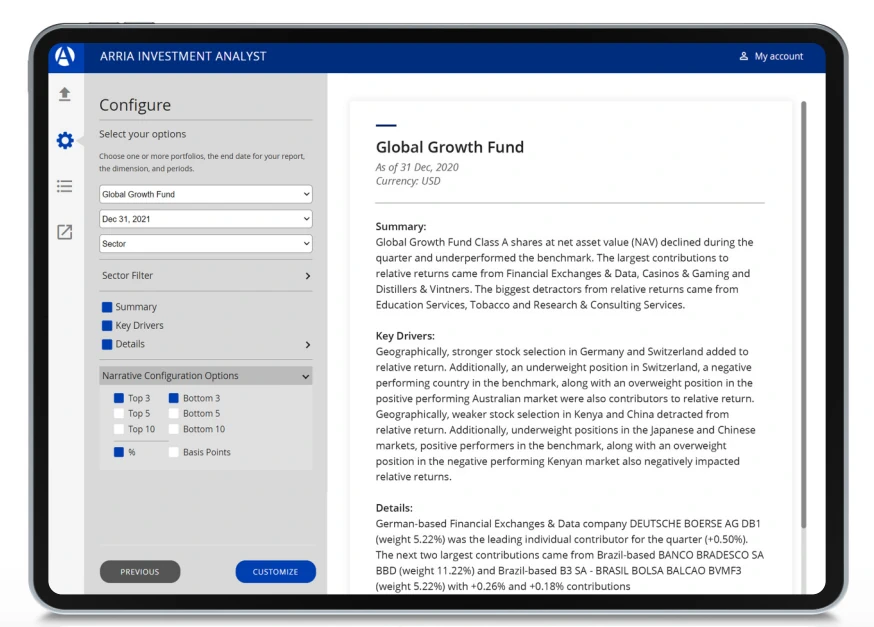

Configure

Select from various measures to interrogate and explain the data. Filters include various dates, top/bottom selectors, contribution to return (CTR), percentages, or basis points.

Customise

Customisation can be made to the document header, dates, portfolio names, and currency names. Although comments can be added to the text and specific words (adjectives/verbs) can be customised, the data facts remain the same.

Consume

Once you automate the investment commentary, select the preferred distribution channel to export your report.

Business Intelligence

Use your preferred analytics tool or Excel Add-In. Arria Investment Analyst can be easily integrated

into all major Business Intelligence (BI) platforms. Select your preferred application to begin adding intelligently generated narratives to your dashboard to augment your visuals with instant insights and unmatched data communication.

Arria Investment Analyst does not only read what the visuals show, it incorporates complementary NLG capabilities with combined weights and returns, giving the user complete flexibility to interrogate all of the underlying data.

Dynamically choose from multiple lenses: Summary, Key Drivers, and Details—and instantly reveal insights to augment the visuals within your dashboard.

Slice and dice data from multiple lenses

Arria Investment Analyst uses NLG intelligence to analyse investment portfolio performance. The slice and dice capability allows you to discover insights and receive data-driven explanations to support your investment decision-making and reporting.

View investment performance through three lenses to better understand and explain the drivers of the portfolio’s performance:

Lens 1

- Generates a data summary

- The portfolio strategy, benchmark, and excess returns indicate the top-level drivers of the out/underperformance

Lens 2

- Illustrates Key Drivers

- Explains the most relevant key components of the relative investment performance

Lens 3

- Delivers Detailed Insights

- Drills down to the security or instrument level and provides narrative on detailed insights, down to the most granular transaction

Bring speed, scale, accuracy, and flexibility to your existing workflow

Instantly turn your portfolio performance data into insightful narrative summaries,

alerts, reports, and fund fact sheets. Arria Investment Analyst allows you to view and deliver

investment reports and alerts in a fraction of the time, with 100% accuracy and consistency of bias. Pre-designed narrative language models are easily customisable to emulate the voice of your firm.

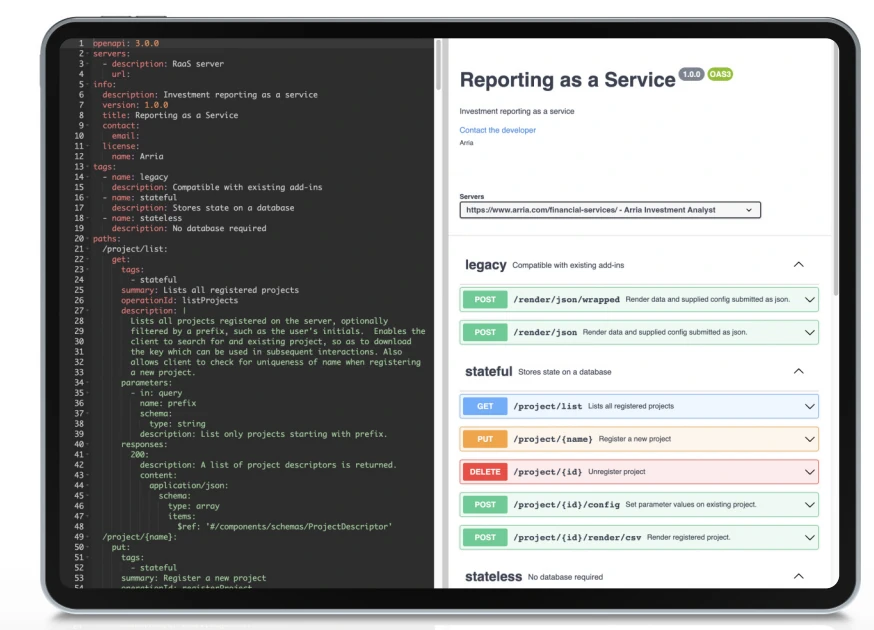

Reporting-as-a-Service (RaaS) – API Integration

Do you want to integrate investment commentary directly into your existing presentation layer or

content delivery network?

Now you can by using Arria Investment Analyst RESTful application programming interface (API). Provide input data and configuration options as a part of a JSON payload and securely request narratives over HTTP.

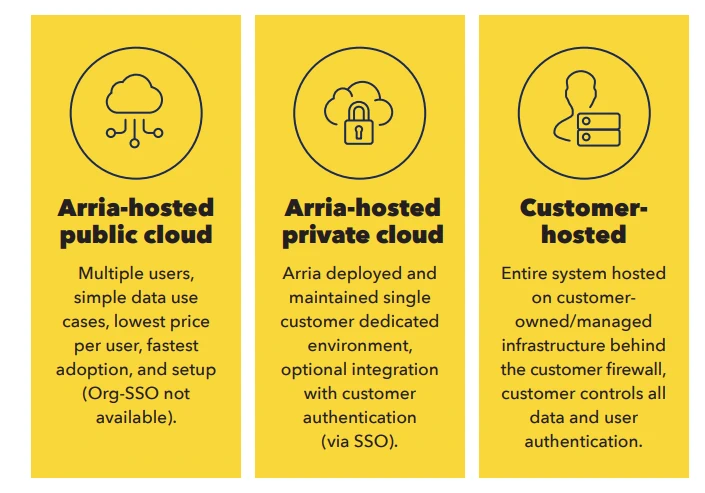

Flexible Deployment Options

Three deployment options with robust security easily integrate Arria’s world-class NLG technology into your infrastructure and accommodate your data security requirements.

How can Arria Investment Analyst automate investment commentary?

To find out more about Arria Investment Analyst please contact us at [email protected] or complete the form below: