Financial Services

Give financial services professionals the most relevant information. Help them make informed business decisions. Break down the complexities of working with numerous products in multiple markets. Show people where the profit is being made and where risks lie.

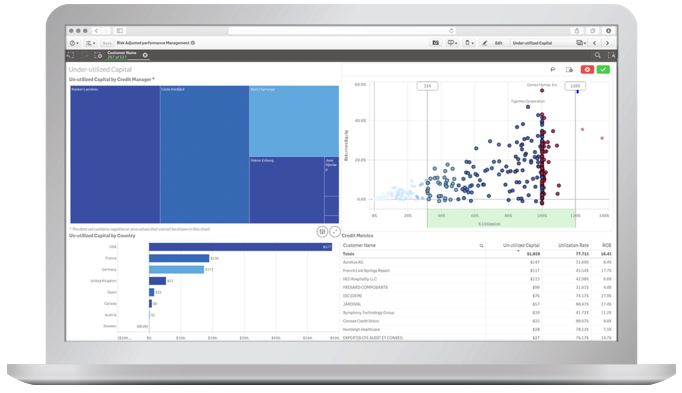

Make analysis powerful and simple

Deliver analytical insights to every department. Give branch managers the tools to find out which customers are driving profits. Enable risk managers to determine global exposures at a minutes notice. Show CFOs which products drive the best returns with the lowest risk.

Banking

Discover new insights about your customers, delivering new insights to the branches as they happen. Streamline operations and IT to reduce your costs and expenses and manage risk and meet regulatory compliance.

Using Qlik, leading banks worldwide can:

- Enhance customer intelligence for sales and marketing through targeting, segmentation, cross-sell/up-sell and profitability analysis

- Improve visibility into transactions, payments, assets, and branch activity

- Better analyse credit quality, counter party risk, operational risk, and exposures in loan portfolios

- Facilitate faster regulatory compliance fraud investigation

- Optimise operations, improve service levels, and streamline IT

- Discover and capitalise on new business opportunities

Insurance

Deliver accurate pricing to optimise win rates. Look for patterns in claims to identify suspicious activity. Analyse every aspect of customer behaviour and relationships. Measure key indicators on loss ratios and claims, and find ways to reduce the claims cycle. Offer the right products to the right customers at the most appropriate time.

Using Qlik, leading insurers worldwide can:

- Analyse customers to uncover new opportunities, identify cross sell potential and improve retention

- Optimise claims processing and enhance claims service levels

- Empower underwriting with visibility into policies, premiums, and loss ratios

- Better assess risk and policy portfolio exposures across products, geographies, and lines of business

- Monitor sales and insurance agent performance and enable self service analysis to field (remote) personnel

- Ensure regulatory compliance and uncover fraud through ad-hoc investigation and reporting

- Optimise operations, improve service levels, and streamline IT

Securities and Investments

Measure and optimise trading strategies. Keep track of counter-parties and collateral. Calculate capital requirements. Measure global exposures across multiple products and optimise hedging strategies. Respond quickly to regulatory inquiries, and manage regulatory submissions.

Using Qlik, leading securities and investments firms worldwide can:

- Improve understanding of market risk, credit risk and intra-day liquidity

- Identify cost reduction opportunities and manage expenses

- Maximise effectiveness and profitability of trading

- Analyse portfolio and multi asset class investment performance

- Provide external clients with powerful self service analytics

- Optimise trade-life-cycles and streamline operations

Have you switched to Qlik?

Over 2,500 financial services institutions rely on the QlikView platform, including all of the top 5 insurance companies based in North America and Europe*, because it empowers business users and decision-makers, providing access to on demand analysis, insights and business discovery.

* 2011 “Forbes 2000” list

Relevant downloads:

Big Data and Analytics in Financial Services

QlikView for Financial Services – cost reduction

Business Discovery for Financial Services

QlikView Financial Services – Top 10 Solutions

QlikView Financial Services – Risk Management