Impact analysis of new financial legislation with Qlik and Inphinity

Impact analysis with Qlik and Inphinity: Coping with business-critical changes in financial legislation is often a significant undertaking. As an example, in the UK payroll has been impacted by the increase in National Insurance contributions.

From April 2022 the rate of National Insurance contributions you pay will change for one year. The amount you contribute will increase by 1.25 percentage points…

https://www.gov.uk/guidance/rates-and-thresholds-for-employers-2022-to-2023

In this instance, businesses would need to analyse the impact on their bottom line, and establish whether to recover the costs from customers. Or whether to absorb and recover the cost through efficiency efforts, if pricing is sensitive.

These kinds of financial budgetary changes can be monitored, measured, and managed effectively with Qlik and Inphinity Forms.

Qlik for finance

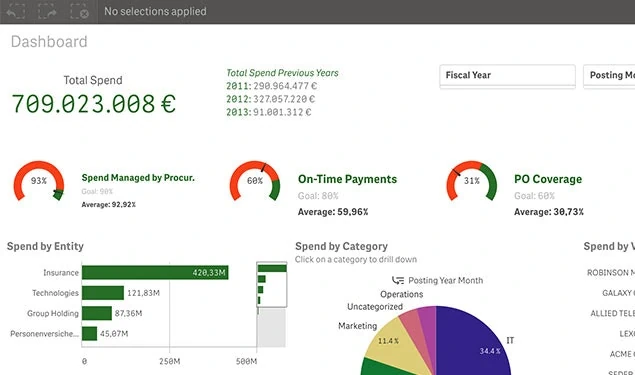

Qlik provides a complete view of your organisation’s finances through Business Discovery. Business Discovery is a user-driven BI that helps people make decisions based on multiple sources of insight: data, people, and place.

Qlik’s financial analytics empowers finance departments with the ability to monitor spending, payments and balances—along with contract status and dates—to more effectively manage the procurement process. Allowing you to find multiple solutions to recover costs following a budgetary change.

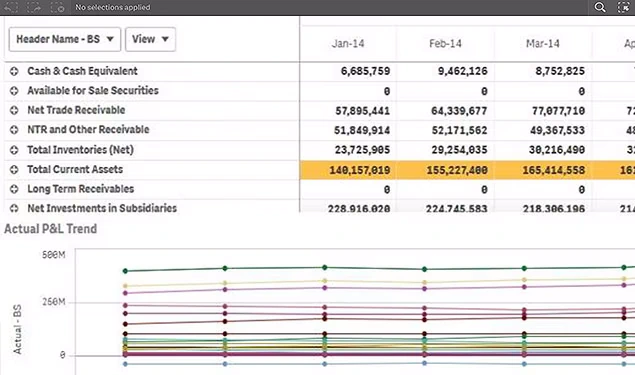

Qlik makes cash-flow and balance sheet management far less labour- and time-intensive. Qlik also creates easy access to insights that enable finance teams to accelerate reporting and reduce financial overhead.

Qlik can also facilitate:

- Financial management

- Profitability analysis

- Financial reporting

- Activity-based costing

- Flash balance sheet

- Expense management

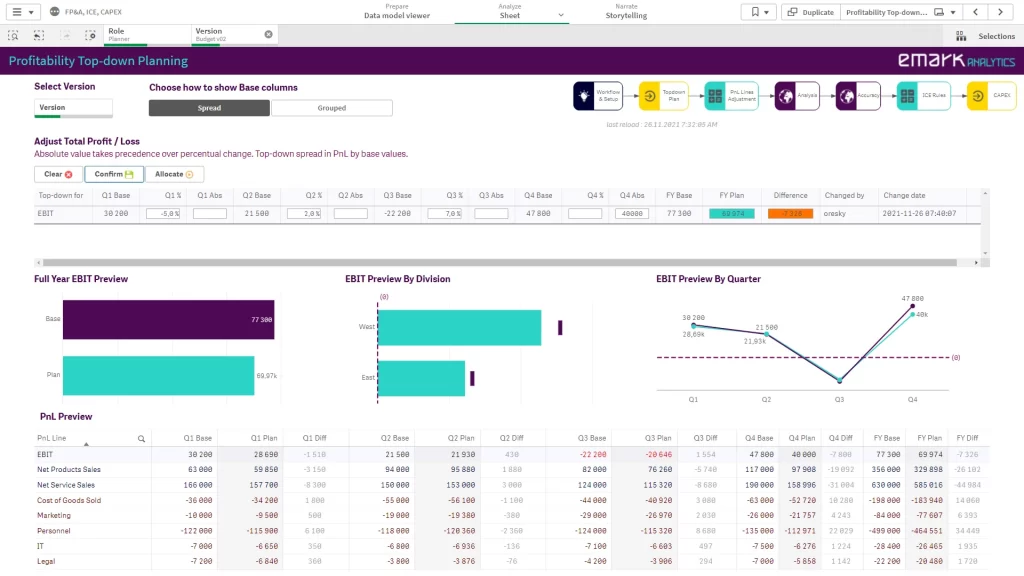

Inphinity Forms for finance

You can use the Inphinity Forms extension to build your own table with data from a Qlik data model and your own editable columns.

Utilise Inphinity Forms, to run a sensitivity analysis, in this case on price. That way you can discover if raising your prices is a viable solution to legislation changes, or whether they should be recovered internally.

Leverage analytics to stay ahead of the curve with your organisation’s finances

Now you know how to analyse your organisation’s finances using Qlik and Inphinity, you might also be interested in learning about how Qlik and Inphinity Suite can help you with your impact analysis and procedures as part of an efficient financial management strategy.

Forecast Financial Changes with Qlik today.

Differentia Consulting provides #SmarterBI solutions offering full life cycle services and complementary business discovery solutions.

Call us on +44 1494 622 600 or email: [email protected]